The consultation on the draft law “Insurance Reform for the Young Generation: introduction of a capitalization system of predetermined contributions to the Supplementary insurance, establishment, organization and operation of the Supplementary Capital Insurance Fund” was recently completed. While we were waiting for it submission in July, we see that it was postponed to September. Its delay, we hope, is in the direction of its improvement. However, some are already turning against it. Rightfully so? Regardless of the position one takes, we all agree that several points need improvement. Some of them have already been duly pointed out – also by the author. But it is time, now that the dust has settled down, for a brief and calm review and evaluation.

Distribution vs capitalization system

A key innovation, introduced by the above bill, is the significant strengthening of the capital nature of Supplementary insurance.

The characteristics of the social security system in our country classify it as distributive (despite any individual and, sometimes, optional elements of capital nature). What does this mean; The social security contributions of today’s employees finance the pensions of (current) retirees. Any social security deficits in this system are fully covered by the state budget. This system works, in fact, effectively when there are many employees and few retirees. What happens when this is not the case, like today in our country? Deficits are accumulating at the expense of the state budget and, ultimately, at the expense of us all.

In the capital system, the contributions of each insured person constitute their own, personal, “savings” which are used to finance their own, only, pension. Not the pention of others. The observance of the contributions is carried out in “individual insurance portions”. The total amount accumulated in the individual insurance shares is managed by specialized managers, who invest them properly-where they are allowed (including: real estate, shares, bonds, etc.). The positive return on investment has a positive effect on the savings of each insured and increases their capital. And, finally, the basis for calculating their pension.

The positives

According to the competent Ministry

The main advantages of the relevant legislative intervention, according to the competent Ministry, are that:

(a) It is expected to lead, based on relevant European experience, to higher supplementary pensions for young insured persons.

(b) It introduces the logic of the “individual piggy bank”, giving the young insured persons more options and more control over the final amount of their pension.

(c) It helps restore young people’s confidence in the insurance system.

(d) It creates a new culture of saving, with significant benefits for the national economy.

(e) It enhances the viability of the insurance system by disconnecting ancillary insurance from adverse demographic developments.

Remarkably

Among the really positive elements of this bill we should, without a doubt (in particular), note:

(a) The Conversion of the supplementary insurance fund from a distributive to a capitalized system (: art. 1)

(b) The Procedure for the Selection of Board Members of the Supplementary Capital Insurance Fund -of the administrator, ie, of the amounts that will be accumulated in total in the individual insurance shares (: art. 12)

(c) The establishment of a (sufficient) Corporate Governance System (: art. 31 ff.) – in particular of the relevant regulations concerning the Risk Management Unit and the Internal Audit Unit.

(d) The possibility of choosing (and / or changing) an investment program by the insured (: art. 62)

(e) The choice to accompany the specific legislation with the three studies (Actuarial for the cost of the transition to the new system and the maturation rate -drafted by the National Actuarial Authority, the Macroeconomic study – drafted by the Foundation for Economic & Industrial Research and the Analysis of its viability Public Debt – drafted by the Public Debt Management Agency), which confirm, in a solemn way, the correctness of the core of the specific legislation.

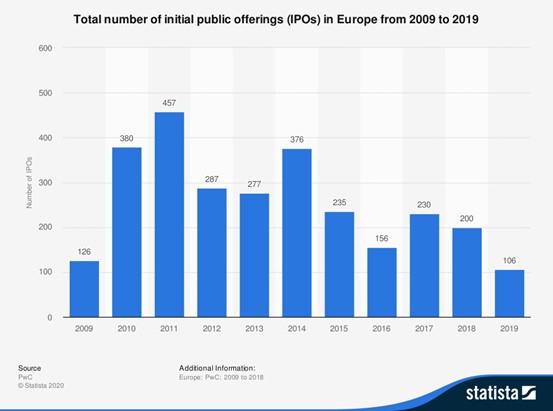

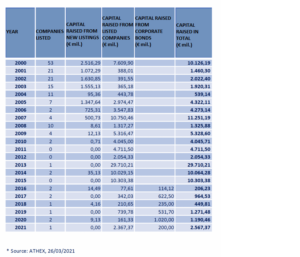

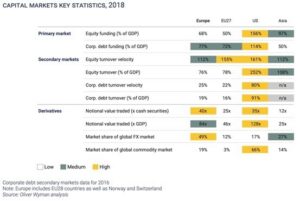

The strengthening of the domestic capital market

Among the, indeed, many advantages of this bill, one more should be added: The strengthening, through the specific legislation, of the domestic capital market and the Greek stock exchange. Through its support, entrepreneurship, growth and, ultimately, the National Economy are expected to be strengthened. It is true that this argument has not been stressed enough by the competent ministry. We easily understand why. The lack of the relevant communication, however, does not diminish its importance and value at all.

Concerns & Suggestions

In addition to the, without a doubt, positive aspects of this legislation, we must also record the following [General -below under (a) and Specific, on the individual provisions -under (b)] concerns and corresponding proposals. Specifically:

(a) General

e-EFKA is called upon to undertake investment activity in the domestic and international capital markets.

The examples and memories of the investment activity, of previous years, of the Insurance Funds (at which time they bought products with reduced collateral – let’s remember the Structured Bonds) were not positive. On the contrary: This investment action created huge deficits in the Insurance Funds and led to their financial ruin. Much more: it was one of the reasons for the long economic crisis (2009) and the consequences, known to all of us, at national, and not only, level.

Past experience therefore requires us to be more careful in order to avoid the recurrence of such phenomena.

(b) The individual provisions

i. Article 28: (Investment Committee)

In this specific provision, the Managing Director, the Head of the Investment Unit and an Employee of the said Unit are appointed as members of the Investment Committee. It is additionally stated: “By decision of the Board of Directors it is possible to add as members two experts from the Public or Private Sector, depending on the needs of the Fund”.

However, in the author’s view, it is necessary for this Investment Committee to be supported by experts of recognized prestige and international experience. Such a reinforcement: (a) will give increased prestige and decisive importance to its suggestions (b) will weaken any ill-intentioned comments made against logic that (should) prevail in the Investment Committee but also against its decisions.

ii. Article 33 & 34: (Risk Management and Internal Monitoring Units)

It is desirable to assist the work of the specific, of special importance and value (in accordance with the remarks made in the introduction) Units by External Consultants of prestige that will be selected according to objective criteria. The active involvement of such External Consultants will work in the direction of transparency and security of the whole system and project.

Let us not forget that, even today, there is not too many capable executives in the market. Even the listed companies, as a result, face serious problems in the staffing of such units – necessary within the Corporate Governance System (mandatory – from 17.7.21).

iii. Article 44 (Overdue Contributions):

(a) According to §3: “the criminal prosecution of the debtors is suspended only with full payment of these contributions”.

In case a debtor does not have the possibility for immediate repayment, their criminal conviction will be inevitable. But what is the case today? The criminal proceedings are suspended as long as there are arrangements in places. The judicial system is burdened in this way, but payments do take place and the sums outstanding are reduced.

In the opinion of the writer, the content of this provision should be re-evaluated: If there is a final conviction of a debtor, they will no longer have any interest in repaying the lenders, in case they lack (explicit) assets.

(b) According to §4: “the payment by the employer… of all overdue contributions…. constitutes a condition for the valid termination… of the employee’s employment contract”.

In case an employer does not have the possibility for immediate payment of all the overdue contributions, they will not be able to terminate the employment contract to which they relate. It is a given that such an arrangement will intensify the pressure for the repayment of the debts.

But what if the employer really lacks the necessary financial means? The employment contract will not be possible to terminate, the arrears of wages will most likely continue to accumulate, and the employee will be forced to resign, depriving themselves of the (always significant) severance pay.

It is possible, therefore, that this provision will work to the detriment of the employee and, therefore, its re-evaluation should take place.

iv. Article 47 (Investment Strategy)

(a) According to §2: “The Fund ensures the adequate diversification of portfolios and the selection of quality investments… In this context, excessive reliance on a specific item or issuer or group of companies is avoided, as well as excessive accumulation of risks in the portfolio as a whole”

It would be desirable to specify in the law (or in a CMO to be issued) the mixture of investments that will be selected (eg listed shares, real estate, deposits, Greece / abroad, etc.) respective to the regulations concerning the operation of the Mutual Funds.

The provision, as it is, creates flexibility, but dramatically increases the risk of reliance on the evaluation of specific individuals in terms of its specialization. It is, in the writer’s view, obvious that the (imposed) dispersion of investment risk should be subject to specific, explicitly defined rules.

(b) According to §3: “Assets are primarily invested in regulated markets”

Investments in shares that are not listed on regulated markets are proving to be catastrophic (based on existing experience as well).

At least the clarification of this provision is desirable.

(c) According to §4: “Investments in derivatives… only if they contribute to the reduction of investment risks or facilitate effective investment management”

Investments in derivatives should, in the author’s view, take place exclusively for hedging.

It is therefore proposed to delete: “or facilitate effective investment management” as the risks that will be created will be inconceivably high.

(d) According to §5: “The fund reserve of benefits is invested in products with low investment risk, as they are determined by a decision of the Board of Directors. After consulting the Investment Committee and the Risk Management Unit… »

It would be preferable to add: “… as well as from the opinion of the external investment manager of article 49 hereof”, a fact that will give security, decisive importanceand prestige to the opinion of the Investment Committee.

v. Article 49: Investment Manager

“… The Fund may enter into contracts for the management of part of its assets with external investment managers.”

In the opinion of the signatory, a wording with the following content is desirable:

“… The Fund is obliged to conclude, for a limited time (not less than one year and not more than three) management contracts for up to 1/5, as the case may be, of its assets with external investment managers, whose work at regular intervals will be evaluated based on the parameters to be set by a CMO to be issued … »

The bill on supplementary insurance is undoubtedly moving in the right direction. The choice of the capitalization system alone over the multi-problematic (due to demographic data) distributive one, would in itself be enough for the positive evaluation of the bill.

However, as there are imperfections that can be further improved, let us not stick to any of the positive provisions of the bill.

And, further, let us not choose, only, its further improvement for the good of future generations and, ultimately, of our national economy.

It is worth using this bill as a basic model for the general reform of the insurance system.

The benefits will be astonishing.

For all of us.-

Stavros Koumentakis

Managing Partner

P.S. A brief version of this article has been published in MAKEDONIA Newspaper (August 15th, 2021).

Disclaimer: the information provided in this article is not (and is not intended to) constitute legal advice. Legal advice can only be offered by a competent attorney and after the latter takes into consideration all the relevant to your case data that you will provide them with. See here for more details.