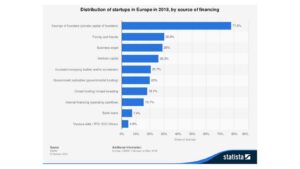

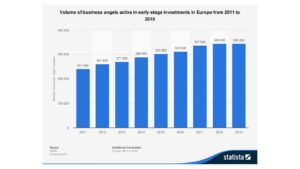

The issue of the financing of startups has been covered in our previous article. In a previous article, we were given the opportunity to approach and, to a large extent, better understand the operation and importance of Business Angels for startups, in particular, operating in Europe, the US and in our country. In the present article we will focus on the incentives provided by the Greek state for the development of the relevant institution and, through it, for the development of entrepreneurship and the Greek economy. Also, to put it bluntly, in protecting what Business Angels and Businesses should enjoy.

Attracting investment funds from Business Angels-the incentives

Generally

The investment culture in our country is not at all typical for the US, nor for the European one. The presence, therefore, of Business Angels in our country could probably be characterized as non-existent. However, their importance in the economies in which they operate is quite obvious. In this context, it seemed necessary to have incentives to attract and involve them.

For a year now, albeit belatedly, there has been the appropriate legislation (: art. 49, law 4712/2020), which would create the necessary incentives for those who would be interested in acting as Investment Angels. With this legislative regulation, the necessary provision was added to the Income Tax Code (: art. 70A law 4172/2013).

The tax incentives

The specific provision, therefore, provides (: §1), that when a taxpayer-natural person contributes capital to a capital company, which is registered in the National Register of Startups, an amount equal to 50% of their contribution is deducted from their taxable income. -in fact, within the year in which the contribution was made.

It also provides (: §2), that:

(a) the specific tax reliefs may relate to contributions up to a total of € 300,000 per investor and per tax year;

(b) capital injections are made to a maximum of three (3) different start-ups; and

(c) up to the amount of € 100,000 per business.

Finally, in order to avoid problems, it records as necessary (: §3) the deposit of the financing through a bank. It also imposes severe administrative sanctions in the event that there is an intention to circumvent the law and obtain a tax benefit without a real intention to finance.

The long-awaited CMO and the way of capital injection

The problem with this legislation, however, was that a prerequisite for the start of its implementation, was (: §4) the issuance of a CMO for the necessary details. This CMO was finally published with a delay of one year (!). This is the CMO No. 39937 / 5.4.21 (Government Gazette B 1415 / 9.4.21), which indeed determines the necessary details for the implementation of the aforementioned provision. The provision of §2 of article 3 is interesting, as it stipulates that:

«2. The capital contribution to a start-up company is made through an increase of its share or corporate capital with the issuance of new shares or corporate shares, respectively, in accordance with the provisions of the existing regulations that regulate the capital increase process of SA, LTD and Private Limited Company”.

Restrictions on tax reliefs

The way in which Business Angels provide financial support is therefore important to them from a tax point of view. In order to achieve the tax reliefs mentioned above, it is necessary to carry out the financial support of the startups through, exclusively, a contribution to their share capital. More specifically, through an increase in share or corporate capital with the issuance of new shares or corporate shares. An increase which (in whole or in part) will be covered by the Business Angel.

It follows, by contrast, that the Business Angel do not qualify for tax relief when, among other things, they undertake to cover the financial needs of the startup in another way. Indicatively, through:

(a) a bond loan convertible into shares;

(b) common loan or bridge financing.

Let us clarify, moreover, that of course such a form of financing by the Business Angel is not excluded. They will simply be deprived of the tax advantages, which in case of acquisition of a part of the share capital they would be entitled to.

The protection of Business Angels and startups

The tax incentives provided by the relatively recent above-mentioned CMO for Business Angels’ investments are consistent with the legislation mentioned in the introduction. This is because only contributions to a capital company (: SA, LTD and Private Limited Company) provide tax incentives to Investment Angels. However, their participation in the share / corporate capital of startups is what calls for both the owners of start-ups and the Business Angels themselves to be alert (of course also from a legal point of view).

From the point of view of the first (: entrepreneurs) it should be completely understood that the involvement of a direct “partner” in the corporate capital means also their participation in the operation of the bodies of their company. It means running a company that is fairly formal and based on some, minimal, corporate governance rules – even if they are not formally subject to them. It means transparency and tolerance of monitoring. It means separation of the company’s finances from those of the entrepreneur. It means, in the end, that there should be a transition to a new mode of operation, different from the one that was, until recently, familiar to them.

From the point of view of the latter (: Business Angels) it should be understood that the necessary audits should take place (legal and other). Also they should review the statutory provisions (and possibly require adjustments) on a number of issues. Among them: those concerning the decision-making process, minority rights, quorum and majority percentages, management, transfer of shares or, as the case may be, corporate shares.

The binding recording of the initial agreement’s individual parameters, the manner of exit of the Business Angels from the investment as well as the safeguarding of both sides (legal and not only) is, of course, up to the provisions of their initial agreement,

The data regarding the role of Business Angels worldwide is impressive. Particularly important, therefore, is their assistance to the economies of the countries where their presence is expanding.

It is in this context that they were provided with the (mentioned in the introduction) – recent tax incentives. We hope, therefore, in the confirmation of the assessment for: “… revitalization of this institution, which will contribute to the strengthening of entrepreneurship and the economy of our country ” of the late President of EVEA-Konstantinos Michalos.

But the tax incentives, although they do not cover all the potential contingencies, do not seem enough. Nor is the absolutely necessary safeguarding of those involved (investors and businesses).

The first thing that should happen is to activate and change the perception of domestic investors-potential Business Angels. (Unless they fall behind and ultimately follow, as is usually the case, foreign Investment Angels, who will be the first to make a move – taking advantage of relevant business opportunities).

We will see…

Stavros Koumentakis

Managing Partner

P.S. A brief version of this article has been published in MAKEDONIA Newspaper (September 12th, 2021).

Disclaimer: the information provided in this article is not (and is not intended to) constitute legal advice. Legal advice can only be offered by a competent attorney and after the latter takes into consideration all the relevant to your case data that you will provide them with. See here for more details.

The Regulations of Corporate Governance Codes

The Regulations of Corporate Governance Codes