Absolutely no one was waiting for the voting of the recent, but also particularly important, law on labor relations (Law 4808/21, Government Gazette A 101 / 19.6.21) to be informed of the existence of incidents of violence and harassment in the workplace. The phenomenon is as old as work itself. Accepted in the past, tolerated later, reprehensible and punishable today. The “me too” movement drastically contributed to the acceleration of the relevant regulations. What is its management by the legislator? In this article we will deal with the extent of this phenomenon, the basic concepts, the obligations of the employer, the new (expanded) role of the Occupational Physician. Also, the relevant (now mandatory) Policies as well as the (necessary) provisions of the Labor Regulations. The subject, due to its extent and seriousness, will be “closed”, in an article to follow, with the rights of the affected persons and the (expanded) role of Labor Inspectorate.

The extent of the phenomenon

We should probably state that we are surprised by the results of the research on workplace bullying that was recently conducted (25.2 / 1.3.21) by Kappa Research on behalf of MRK Consulting and was presented, among others, to the members of Hellenic Human Resources Management Association. Not that we did not know about the phenomenon. We did not imagine, however, its extent.

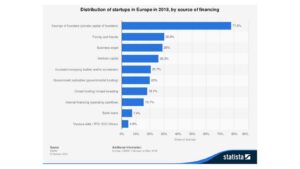

Here are just a few of its striking conclusions:

85% of the participants (men and women) consider that the phenomenon of workplace bullying is so widespread that it is a serious social problem.

Participants state that they have suffered or perceived to take place: inappropriate comments of sexual nature – 19% of participants (but 29% of women), physical violence – 9% (: 10% of women), suggestions of sexual content as a prerequisite for professional development -7% (: 12% of women), sexual assault -3% (: 5% of women).

It is more than obvious that violence and harassment in the workplace mainly, but not exclusively, affects women.

Four out of ten employees (both in the private and public sectors – 46% are women) say they have been the target of workplace-related bullying (more often: verbal violence, job degradation and gossip – not least sexual harassment and physical abuse).

Nearly one in two employees who reported being bullied at work are still employed by the business (or organization) in which they were targeted, and about 20% of victims continue to experience bullying, even today.

The reaction of the colleagues of the victims is interesting – in two ways. 43% of the victims state that their colleagues, in addition to the main source, participated in their bullying. On the other hand: only 52% of the victims received support from their colleagues.

And as for the management of the business: usually it knows but it does not react. Only 1 in 10 businesses take effective action after a bullying incident.

Prohibition of violence and harassment

Therefore, taking into account the size of the problem, we read with satisfaction in the specific, mentioned in the introduction, legislation: “All forms of violence and harassment, which occur during work, whether associated with it or arising from it, including violence and harassment due to gender and sexual harassment are prohibited.” (Article 4 §1).

But what is violence and harassment?

According to the law (art. 4) “violence and harassment” are behaviors, acts, practices or threats that aim or may lead to any form of harm (: physical, psychological, sexual or financial) of the victim.

“Harassment” is behavior that aims at or may lead to a violation of the dignity of the person and the creation of a problematic environment for the victim and, finally,

“Harassment due to the gender of the victim” is gender-related behaviors that target or violate a person’s dignity and create a problematic (intimidating, hostile, degrading, humiliating, or aggressive) environment. This includes, but is not limited to, sexual harassment, as well as behaviors associated with sexual orientation, expression, identity, or gender characteristics.

Field of application

The specific law covers (a. 3) the employees in the Private and Public Sector. It covers all employees, trainees, apprentices, volunteers and even those looking for work and the uninsured.

Prohibition of violence and harassment; where?

Prohibited violence and harassment may take place (a. 4):

(a) in the workplace (where, for example, the employee works, takes a break, in personal hygiene and care areas, in locker rooms, even in accommodation provided by the employer),

(b) while commuting to and from work and even during travel, education and work-related events and social activities; and

(c) in communications related to work of any nature (face to face or using technology or computers).

What are the obligations of the employer – in general

Employers (and those who represent them) are obliged to (art. 5):

(a) show zero tolerance for violence and harassment;

(b) receive, investigate and manage any relevant complaint in confidence and with respect;

(c) provide assistance to any competent authority upon request;

(d) provide employees with information on potential related risks and prevention and protection measures (including: obligations and rights of employees and employer);

(e) post in the workplace and make accessible information on relevant procedures at business level as well as the contact details for the competent authorities.

The obligation of the employer to inform the employees

Employers are obliged (art. 6) to inform their employees about the legislation on health and safety at work and how it is implemented by the business. Also, they are obliged to inform them about safety and health risks but also about protection and prevention measures and activities. It should be noted that the specific risks and measures include those for combating violence and harassment at work (of course, sexual harassment included).

The obligation of the employer to assess risks and take measures

The employer is obliged (among other things a. 7 / a. 42 §6 law 3850/2010) to:

(a) draw up a plan of preventive action and improvement of working conditions in the enterprise;

(b) assess psychosocial risks, including violence and harassment and sexual harassment; and

(c) take measures to prevent, control and mitigate these risks.

The (new) responsibilities of the Occupational Physician in matters of violence and harassment

The occupational physician must now (d. 8 / d. 17 §2 & 18 §2 law 3850/2010) (also) advise on issues of violence and harassment-including sexual harassment. They advise, inter alia, on the integration or reintegration of persons who are discriminated against or victims of violence and harassment.

The occupational physician now supervises (art. 17 §2 law 3850/2010) and informs (also) on issues of violence and harassment-including sexual harassment. Also: they inform employees about the dangers of their job, as well as ways to prevent them, among which are the risks of violence and harassment – including sexual harassment.

The occupational physician, finally, provides emergency treatment – including in cases of violence in the workplace.

Policies to combat violence and harassment

The law mentioned in the introduction establishes, for the first time (art. 9), the existence and implementation of Policies to combat violence and harassment. It is important to note that their implementation should take place no later than 19.9.21.

The existence of these Policies is mandatory for businesses with more than twenty employees. They should, in fact, include the employer’s declaration of zero tolerance for violence and harassment. Also, the rights and obligations (of both employees and the employer) to prevent and deal with such incidents or behaviors.

They also include (at least – among others): assessment of the relevant risks at work, measures for the prevention, control, reduction, treatment & monitoring of such incidents or behaviors and risks, information and awareness actions of the staff, mentioning of a liaison- responsible person for guiding and informing employees on such matters, the protection of employment and the support of employees – victims of domestic violence.

Policies for managing internal complaints

Along with the existence of policies for the fight against violence and harassment, the Policies for the management of the relevant internal complaints are also mandatory (article 10). Here, too, the policies mandatory for businesses with more than twenty employees are identified.

These Policies concern the management as well as the process of receiving and examining the specific complaints (with respect to the protection of the victim and to human dignity).

They include (at least) secure and easily accessible communication channels for receiving complaints, identifying the persons responsible for receiving them, examining and managing them. The policies ensure the investigation of the complaints with impartiality and the protection of the confidentiality and personal data of victims and complainants. They provide for the (absolutely necessary) prohibition of retaliation and further victimization of the affected person and the cooperation with the competent authorities. They determine the consequences in case of violation.

Content of Labor Regulations and Business Collective Employment Agreements

Policies for the prohibition of violence and harassment (a. 9) as well as those for the management of internal complaints (a. 10) should be the subject of collective bargaining (as the content of the General National Collective Employment Convention or the Work Regulations -a. 11). However, in the absence of trade unions and employees’ councils, the Policies are drawn up by the employer, after the latter informs the employees and posts the relevant policy draft in the workplace or notifies them, in order to receive their views.

When there is a Work Regulation (or the obligation to draft one), its content must include provisions for disciplinary offenses, disciplinary proceedings and disciplinary penalties in the context of or following complaints of incidents of violence and harassment.

The issuance of a Ministerial Decision with examples of the aforementioned Policies is expected (a. 22).

Incidents of violence and harassment in the workplace have never disappeared. But in the past, they were treated as “normal”. Let us remember the 1963 film “Tis Kakomoiras” (aka “Bakalogatos“), the adventures of the (very much) likeable Zikos but also the behavior of his boss against him, which was in fact logically expected, as the former was “just the help”.

Such phenomena must no longer be tolerated.

Working women are, unfortunately, affected dramatically more than their male colleagues.

The legislator belatedly and, rather, after having fallen behind, followed the trends of the time. The “me too” movement rightly affected working relationships as well.

Employees should be and feel safe. Women and men.

Of course, in the legislator’s attempt to protect the victims, some exaggerations were not avoided, but regarding them see our, relevant, next article.-

Stavros Koumentakis

Managing Partner

P.S. A brief version of this article has been published in MAKEDONIA Newspaper (August 29th, 2021).

Disclaimer: the information provided in this article is not (and is not intended to) constitute legal advice. Legal advice can only be offered by a competent attorney and after the latter takes into consideration all the relevant to your case data that you will provide them with. See here for more details.