Ι. Preamble

The German company Western & Co was the one to undertake, in 1891, the coverage of certain needs of the Swiss army, with a tool that would most likely be used in two ways. The Swiss soldiers would use this tool to disassemble and reassemble their gun (: screwdriver) or open a can to feed themselves (: can opener).

This (multifunctional) tool was called Model 1890.

The Swiss Karl Elsener had a company which was manufacturing surgical equipment.

But because of his national pride, and, probably mainly, because of the business interest he had in this endeavor, he decided to give to the Swiss army more than just Model 1890. To do so, he made additions to the initial version of the tool. He added a corkscrew, a second, smaller blade and a pair of scissors. He established a company which he called Victorinox, using as a logo the Swiss cross in a red shield. This company, famous till this day, specializes -as we all know- in swiss army knives.

The question is, which of the following would be more useful: a swiss army knife – multi-tool, a cheap knock-off or, just, a collapsible pocketknife?

And, for our purposes:

In our effort to compare Private Companies and Societe Anonymes, could we figure out which would be the best company type to go for? And, to take it a step further: which of the two would be the swiss army knife and which the collapsible pocketknife?

Let’s attempt a brief comparison of the business aspects of the two company types. This way maybe we could give answers to specific questions.

ΙΙ. The legal status of a Société Anonyme and a Private Company

Both Private Companies and Societe Anonymes are capital companies (which essentially means that capital is very important in these company types).

The first (Private Company) sometimes heavily resembles a partnership. The SA, on the other hand, is the clearest example of a capital company.

Both company types are now well established in the Greek business reality.

An SA is mostly chosen when the end goal is to create a business with a significant capital base and higher activity.

The PC was created as a company type–step between an LLC and an SA. But, from the comparison of a PC and an LLCwe have already concluded that the existence of PCs have rendered LLCs irrelevant.

On the other hand, we have already established that Société Anonyme offers significant business opportunities. We actually draw most of the arguments of the present from our previous article.

Given all the clear prevalence of the two company types (PC and SA), a comparison of the two would be useful. The main objective would be to figure out which of the two company types is “better”.

ΙΙΙ. Comparing SAs and LLCs

It is important to draw (relatively) safe conclusions when it comes to studying the two company types. Analyzing the ten most important aspects of any organized business could be a way to do so. When assessing, from the business point of view, the SA, we pointed the aspects that set the SA apart from the other company types. Let us now assess a comparison of SA and PC.

1. Establishment

1.1. Regarding SA

An SA can now be established in minimum time and with an close-to-zero expense. The articles of association are, of course, necessary.

Since 2016 (article 9 act 4441/2016) the participation of a notary and a lawyer often proved redundant.

The recent act adopts a provision previously in force, which, in some cases, allowed for an SA to be established with a private document (article 4 §2 act 4548/2019). A necessary requirement is to be using the official model articles of association and submit it to the relevant “one stop shop” of the Business Registry. An important prerequisite: to not diverge from the official model. Small (?) detail: the “one stop shops” still only have available models drafted according to the (abolished since 1.1.2019) act 2190/1920…

In more complex cases (as well as in cases where the founders wish to divert from the provisions of the official model) the SA can only be established with a notarized document. A notarized document is also required when a legal provision specifically calls for it, or if contributions in kind are made to the company, contributions that in order to be transferred a notarized document is required (article 4 §2 act 4548/20190).

But still in cases where the articles of association can only be valid if they come in a notarized document, there is a way to minimize costs. Choosing small (size-wise) articles of association – by avoiding unnecessary repetitions of the law, is the best practice. The cost (at least of the official copies) will be significantly smaller. And even more so: possible amendments of the law will not create a need to amend the articles of association accordingly.

1.2. Regarding PC

A PC is established and amended with a private document. The speed and low cost of establishing and amending it is one of the main reasons why it is, at least at a first glance, so appealing.

But the “private document rule” does have some exceptions.

A notarized document is mandatory for a PC in some specific cases. In case, for example, that such is required by a specific law or when specific assets are contributed to the company, whose transfer requires a notarized document (e.g. immovable property or rights in rem in immovable property). Additionally, a notarized document can be chosen by the company’s founders or founder (when talking about a single member PC) (article 49 act 4072.2012).

A PC is established and amended with a private document as well.

1.3. Conclusion

Based on the aforementioned, we come to the conclusion that when it comes to the form of the document necessary for the establishment, the flexibility and the expenses relating to the establishment:

- For the simplest of the cases it seams that no company type deserves a winning point. Both company types can be established with a private document and by adopting the formal articles of association provided.

- But when considering those more complex cases, we must award the point to PC. Diversions from the formal articles of association provided for PCs can still be in the form of a private document. But when dealing with an SA, the smallest diversions from the formal articles of association and the document must be notarized.

So: Societe Anonyme – Private Company: 0-1

2. Attracting and keeping capable executives – minimizing salary expenses

It is extremely important for all businesses to achieve, among others, a triple goal:

- Attract capable executives,

- Keep them for a long time,

- Minimize their cost.

When the (given) conflict of interests between management and ownership minimizes, at least by a little, everything becomes simpler. What are the relevant tools offered by an SA and what by a PC?

2.1. Regarding SA

The Act on SAs – 4548/2018 offers multiple opportunities to SAs, in order for them to successfully tackle the (given) conflict of interests between them and their executives. Some of them are Stock Options (article 113 act 4548/2018), Bonus Shares (article 114 act 4548/2018) and/or Ordinary Founders’ Shares (article 75 act 4548/2018).

2.2. Regarding PC

The provisions of the law are insufficient.

The attraction of capable executives in a PC and the mitigation of the contradiction of their interest with the interest of the ownership are both covered by only one provision of the relevant act. To be more precise: the opportunity of an executive to become a partner in a PC by making non-capital contributions (meaning contributions that are not made in money or cannot be assessed in money). Such are the demands deriving from the undertaking to conduct works or provide services. Those contributions are made either at the stage of the establishment of the company and/or at a later time. Both the kind of the contributions and their value are determined freely by the partners (article 78 §§ 1 and 2 act 4072/2012).

In other words: we offer to the executive the opportunity to become a partner of the PC, without them having to contribute capital. Instead of money, they undertake the obligation to simply offer their services.

The convergence of the interests of the executives and the business is achieved in this particular way, which is provided by law.

Is it possible for hybrid schemes to be created, schemes relevant to those offered in Société Anonyme (: stock options etc)? The answer is affirmative, but it would never be possible (with them being, by default, hybrids) for those schemes to provide sufficient security. Neither for the business, nor for the employee.

2.3. Conclusion

Based on the aforementioned, there is no doubt that the SA clearly prevails in this section. And, because the relevant tools available in an SA are plenty, a three-pointer must be awarded.

The score now is:

Societe Anonyme – Private Company: 3-1

3. Cost savings for the company and the partners/shareholders

The main goal of businesses and, of course, of partners/shareholders is to seek profit. This goal can be achieved through, among others, cost savings and reduction of expenses. Such are possible by, among others, minimizing salary expenses and utilizing technology. In detail, per company type:

3.1. Regarding SA

When an SA is established, it, of course, needs articles of association. The articles of association can be drafted at (almost) no expense, if the formal model articles of association are adopted. Meaning, the company can be established with a private document.

But still in cases where the articles of association can only be valid if they come in a notarized document, choosing small (size-wise) articles is an effective way to minimize its cost. Such can be achieved by avoiding unnecessary repetitions of the law.

When the company operates, minimizing expenses can be achieved by utilizing technology. The relevant provisions of the law are multiple and do suffice (below, under 7.1.). Minimizing expenses can also be achieved by utilizing tools for the reduction of salary expenses (above under 2.1.).

Both when an SA is established and when it operates, its shareholders have options to save money. The partial, only, payment of the share capital (article 21 par. 1 act 4548/2018) is one of the tools available. By taking advantage of this option given, the shareholders must only pay part of the capital they undertake to pay. As for the rest, they undertake the obligation to pay for it sometime in the future.

3.2. Regarding PC

When the company is established, as mentioned above (under 1.3.) the cheapest company is PC.

But when the PC operates, there are close to no tools to minimize salary expenses (above under 2.2.).

The act on PCs offers enough provisions for the utilization of technology (below under 7). Expenses can be reducedthis way.

When it comes to depositing the capital owed, there is no provision allowing its partial only payment to the PC. The capital must be deposited in its entirety when the company is established, or its capital is increased (article 77 par. 4 a’ act 4072/2012). However, PCs can have zero capital (article 43 par. 3 a΄ act 4072/2012). Additionally, it can be established only with non-capital contributions (article 78 act 4072/2012) or with contributions in the form of guarantees (article 79 act 4072/2012). In these cases, there is no need for the partners to freeze funds of theirs.

3.3. Conclusion

In this section PC seems to slightly prevail over SA when it comes to the stage of establishment. But at the stage of operations, the SA has more and more significant tools available.

So at the end, SA seems to have a lead on PC. So, with a light heart, we can award the winning point:

Societe Anonyme – Private Company: 4-1

4. Attracting investment capital

The financial crisis that our country has been experiencing for the past years has significantly restricted bank lending. This fact has driven/forced businesses to seek alternatives. Those alternatives are often a necessary prerequisite for their development and, sometimes, survival.

4.1. Regarding SA

The act on SAs offers a wide range of tools accommodating the attraction of investment capital.

The tools offered are (among others):

(a) Warrants (article 56 act 4548/2018), which offer the right to those who hold them to acquire, sometime in the future, shares of the company which issued them, in a pre-determined, low price.

(b) Preference Shares (article 38 act 4548/2018), which can offer a wide range of privileges.

(c) Redeemable Shares (article 39 act 4548/2018) offer the right to their owners to request to have them, sometime in the future, bought by the company which issued them, in a beforehand agreed upon price.

(d) Bonds (article 59 et seq. act 4548/2018).

(e) A combination of the above “tools”.

4.2. Regarding PC

A PC completely lacks relevant tools to the ones an SA has. It is, of course, possible to design hybrids (relevant to those of SAs), but safeguarding interested investors would not be easy or, to an extent, possible. And with limited guarantees, not many would be interested to invest in a PC.

4.3. Conclusion

The predominance of SAs is perfectly clear here as well. Since the tools available in an SA are multiple, a three-pointer must no doubt be awarded.

The score now:

Societe Anonyme – Private Company: 7-1

5. Drawing liquidity from the company

Most businesses in Greece are family-owned. The shareholders/partners often falsely confuse the company’s accounts with their own “pockets”. The consequences from the unnecessary drawing of liquidity from companies by the businessmen are often severe. This act is an (often felonious) embezzlement and could possibly also have administrative, tax and civil consequences. There are, though, lawful ways for the shareholder/partner to actually draw liquidity from their company without the aforementioned consequences.

5.1. Regarding SA

The most common tools are: (a) for the members of the Board to participate in the company’s profits, and (b) the conclusion of contracts between the SA and its major shareholders, BoD members and related parties.

As significant (if sometimes not more significant) as the above tools are, among others, the following:

- The distribution of dividend (final or interim),

- The Deduction of the Capital (articles 29 et seq. act 4548/2018),

- The Amortization of Capital (article 32 act 4548/2018),

- The issuance of Ordinary Founders’ Shares (article 75 act 4548/2018) and

- The issuance of Extraordinary Founders’ Shares (article 76 act 4548/2018).

5.2. Regarding PC

The PC does not have such a “toolbox”. The methods for drawing liquidity from a PC are clearly more limited.

The partners participate in profit correspondingly to the percentage of the company share they hold (article 100 par. 4 act 4072/2012). However, PC partners cannot receive interim payments of the profits that are to be distributed (whereas SA shareholders can).

Paying a fee to the PC’s manager for the services they offer is allowed, but only if there is a relevant statutory provision or a decision by the partners (article 64 par. 4 act 4072/2012).

It is also possible to reduce the capital of the PC, as long as capital contributions were made and are still available. The reduction takes place with the cancellation of the shares that correspond to those contributions (article 91 par. 1 act 4072/2012).

5.3. Conclusion

The predominance of the SA is impressive. Again, in this case the tools available in an SA are numerous. Three points should be awarded here as well.

The score now is:

Societe Anonyme – Private Company: 10-1

6. “Managing” small shareholders/partners

The existence of persons holding minority shares is common in businesses. It is fair enough to protect those holding minority shares from possible abuse of the power held by the majority. But it is equally fair to protect the majority from possible extortionate or malevolent behavior of the minority. What are the tools offered by each company type?

6.1. Regarding SA

Act 4548/2018 offers a rather wide range of tools in that regard.

The act strengthens, as it seems, the rights of the minority, especially through the right given to them for exceptional auditing. Nonetheless, the existence and the implementation of the minority’s rights are not always enough to achieve the necessary balance in the relations between the minority and the company. Often, the exit of the minority shareholders from the company is in the best interest of both them and the company.

The minority shareholders can reach the exit by taking five, among others, ways:

(a) By the option given, under conditions, to the minority shareholders (holding ≤5% of the share capital) to request before a court:

(aa) the redemption of their shares by the SA (Act 4548/2019, article 45) and

(ab) to be bought-out by the majority shareholder (holding ≥ 95% of the share capital) -(Act 4548/2019, article 46)

(b) By the option given, under conditions, to the majority shareholder (≥95%) to buy-out the minority shareholders(Act 4548/2019, article 47)

(c) By the increase (ordinary or extraordinary) of the share capital, as well as

(d) By a (combined) decrease and increase of the capital.

6.2. Regarding PC

The PC does not have such a toolbox.

It is noteworthy that the acquisition of own shares is strictly prohibited in PCs (article 87 act 4072/2018). Nonetheless. In PCs, just like in SAs, there are provisions for the increase (article 90 act 4072/2012) and decrease (article 91 act 4072/2012) of the capital. The use of these (rather poor) tools offered, could possibly help achieve the intended goals. At least up to a point.

6.3. Conclusion

There is no question that the SA prevails by a lot. The tools offered by the SA are multiple. A three-pointer in favor or the SA is what is appropriate in this case.

The score now:

Societe Anonyme – Private Company: 13-1

7. Utilizing technology

We are at the heart of an era characterized by fast and rapid technological changes. As a result, technology could not be neglected by the acts regulating the two company types.

7.1. Regarding SA

The Act on SAs facilitates, by providing plenty of relevant provisions, the utilization of technology. For example, technology can be used in an SA:

(a) for issuing intangible shares and digitally keeping the Shareholder Book (Act 4548/2019, articles 34, 40 par. 2 & 5),

(b) for the board of directors to conduct its business and take decisions (Act 4548/2019, articles 90 & 94),

(c) for shareholders to exercise their rights through emails (Act 4548/2019, articles 122 & 123),

(d) for General Assembly Meetings and forming of the relevant decisions (remotely and by electronic means – Act 4548/2019, articles 125 to 128, 131,135 and 136),

(e) for shareholder unions (Act 4548/2019, article 144).

7.2. Regarding PC

In PCs, partners can hold meetings remotely and form decisions using electronic means (articles 125 through 128, 131, 135 and 136 act 4548/2019, 71 και 73 ν. 4072/2012).

At the same time, PC is obligated to keep a company website, through which certain company information are made public (article 47 par. 2 act 4072/2012).

7.3. Conclusion

SA prevails here as well. Its prevalence, although not impressive, is still a fact. The point goes to SA. The score:

Societe Anonyme – Private Company: 14-1

8. Succession

Both SA and PC are, as already mentioned, capital companies.

PC, by default, resembles a partnership. And, exactly because the business reality in Greece is family-centric, Greek SAs too often have strong family/personal characteristics. It is common knowledge that succession is an issue that concerns all businesses with strong family/personal characteristic. Succession, i.e. the transfer of the business to the next generation, is an issue for which businessmen need to plan ahead. Succession-related issues are successfully tackled if the businessman approaches them with maturity and asks for the contribution of the right advisors. The company’s articles of association will play a definitive role in this regard.

8.1. Regarding SA

In SAs, a great help towards solving succession issues can be drafting “tailor made” articles of association. Those that will:

(a) Set, in advance, reasonable rules for restricting the free transferability of shares. Introduce a procedure that can take place through issuing restricted shares (Act 4548/2019, article 43). The restrictions apply on all transfers, including the ones owing to the death of a shareholder.

(b) Regulate (in the most appropriate way and reasonably) the exercising of the rights of the minority. Also, the rights of minority shareholders concerning auditing.

8.2. Regarding PC

Similar provisions (to the ones mentioned under 8.1.) are found in the act on PCs as well. Provisions restricting the free transferability of company shares can be included in the latter’s articles of association (article 84 act 4072/2012). The articles of association can forbid or restrict the free (inter vivos) transferability of company shares. It can also provide pre-emption rights to the remaining partners, in case a partner transfers their shares. Additionally, it can provide the company with the right to suggest a specific partner or third party to buy the shares that are to be transferred.

Similar rights can be provided for the surviving partners and for the company for transfers as a result of death (article 85 act 4072/2012).

8.3. Conclusion

In this section the SA does not strikingly prevail over the PC. But since the act regulating the first one is younger, its provisions are more up-to-date. The act on PCs for example does not entail provisions such as the Tag and Drag Along Right. Despite the fact that the SA does not strikingly prevail over PC, it still prevails. The point goes to SA here as well. The score:

Societe Anonyme – Private Company: 15-1

9. Protecting the investment

It is not enough for businesses to be able to attract investment capital. It is necessary that they are able to keep it and protect it as well. An important role in this regard plays a carefully drafted, tailor made, statute. A statute that will be carefully defining the relationships between shareholders/partners, so as to avoid internal disputes.

9.1. Regarding SA

The rights of the minority shareholders and how they are exercised must, in this case as well, be carefully defined. Even more so when it comes to the rights of the minority shareholders concerning auditing.

Another important issue for most SAs is securing the “next day” and the business venture, meaning securing the company’s and the existing shareholders’ interests. A possible transfer, i.e. of company shares to a competitor would, most likely, not be at the interest of the company. A provision for restricted shares appears to be necessary here as well.

Establishing the reasonable (and probably necessary) restrictions that are the Tag Along Right and the Drag Along Right seems, in most cases, necessary.

But necessary in all cases are:

(a) The provisions in the articles of association regarding the protection from possible competitive and unfair actions taken by the BoD members, the executives and the shareholders.

(b) The careful selection of the SA’s representatives.

(c) The careful definition of boundaries of the responsibilities of each one of its representatives.

9.2. Regarding PC

Everything mentioned (above under 9.1) for SAs apply in PCs as well. Statutory provisions regarding the rights of the minority (the right of auditing included) can be included in a PC’s statute as well. In a PC, though, one cannot provide for Drag and Tag Along Rights. But it is possible to include statutory provisions (as already mentioned above, under 8.2) for restricting the free transferability of the company shares.

9.3. Conclusion

In this section we seem to not have a clear winner.

Let’s leave the score as is.

Societe Anonyme – Private Company: 15-1

10. Protecting the natural persons involved:

The representatives/managers of a business do carry major responsibilities.

10.1. Regarding SA

The range of the responsibilities of the members of the board of directors is very wide. Civil, criminal, administrative liabilities before the company, before third parties, etc. These liabilities can be put in two large categories:

(a) The responsibilities of the members of the board of directors, according to the Act on SAs

(b) The other responsibilities of the members of the board of directors

The responsibilities of the members of the board of directors cannot be set to zero. But they can be limited. Solutions towards that direction (among others) are:

(a) The reduction of number of the persons involved (i.e. through the provision of a Single-Member Administrative Body / Consultant-Manager)

(b) The Insurance Of The Liability Of The Members Of The BoD And Of The Executives Of The S.A.

10.2. Regarding PC

PC’s managers do have responsibilities relevant to those of SA’s representatives (article 67 act 4072/2012). Much like in the case of SA, PC’s managers’ responsibilities are unavoidable. Limiting the number of persons-representatives involved with the PC and insuring them is possible in this case as well.

10.3. Conclusion

In this section, analyzing the last of the company aspects we will study in the present article, neither SA or Private Company prevails.

The final score is overwhelmingly in favor of SA:

Societe Anonyme – Private Company: 15-1

IV. Businessmen’s choices

SA and Private Company serve different purposes and have different advantages. Some aspects of theirs do resemble each other and some others do not.

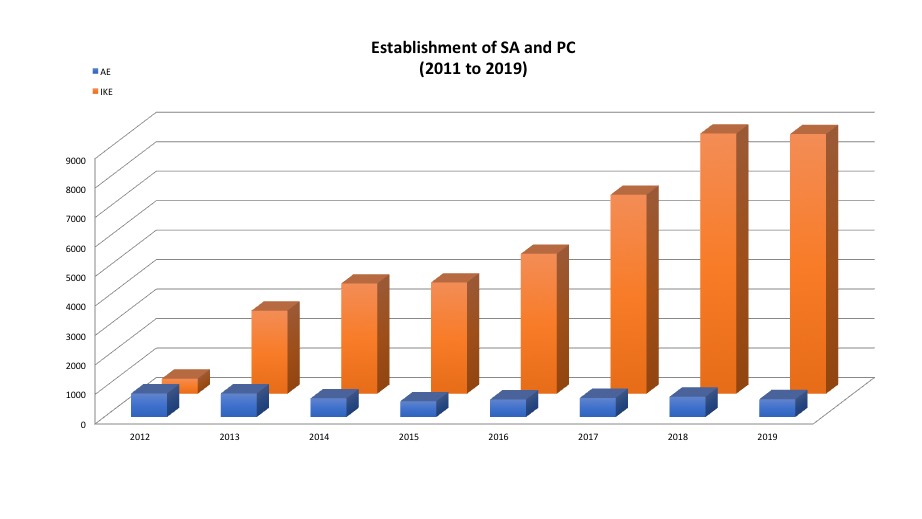

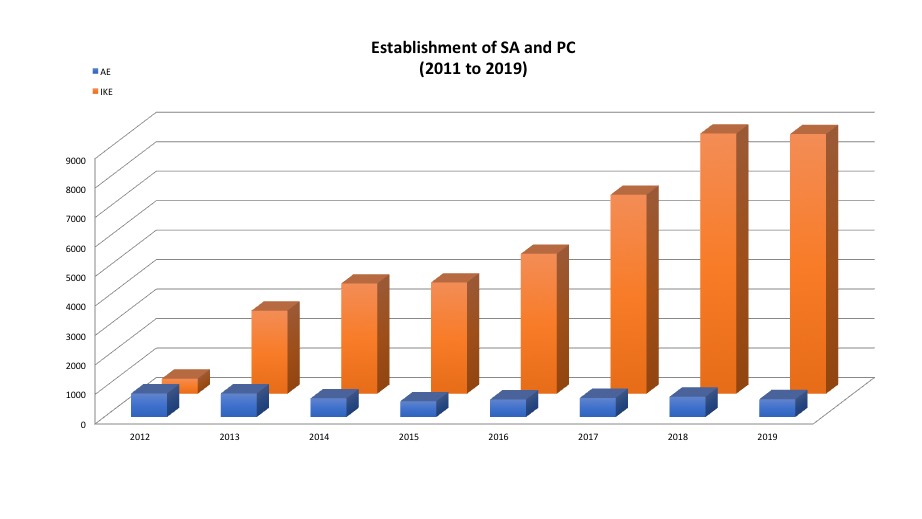

Despite the fact that SA and Private Company address different audiences, it is interesting to take a look at the Business Registry’s data for the years 2012 (when Private Company was established) until late-October 2019. And to be more precise:

Business Registry’s statistical data shows that the number of SAs established yearly is kept, notwithstanding some minor fluctuations, rather steady.

On the contrary, the establishment of Private Company is steadily rising. Its flexibility and the fact that it is cheap and simple are, quite certainly, the reasons why it is preferred over SAs.

V. In Conclusion

SA and Private Company never competed against each other.

Private Company prove to generally be cheaper than SAs. Of course, more flexible as well. And this is why they are generally preferred.

But their “audience” is different. Bigger schemes, bigger investments and businesses wanting to take advantage of the tools the act on SAs provides, must, no doubt, choose the SA as the most fitting company type.

The result of the comparison of these two company types, as mentioned above, is overwhelmingly in favor of Société Anonyme.

And if we were to refer to SA as the “swiss army knife” by Victorinox (as the multitool that it is), we could not but consider Private Companyto be the “pocket knife”.

Let’s say it is collapsible as well…

P.S. A brief version of this article has been published in MAKEDONIA Newspaper (November 10th, 2019).